New figures show that the YouGov/Cebr Consumer Confidence Index is increasing at its slowest rate since February.

This comes as Office for National Statistics data show that consumer spending accelerated to grow by 0.8% quarter-on-quarter in Q3. But the YouGov/Cebr data covering the first two months of Q4 show recent improvements in consumer confidence are starting to level off.

YouGov and Cebr’s figures suggest the rapid surge in consumer optimism seen since the start of the year could be reaching a plateau because people’s outlook over their own household finances is not keeping pace with their improving confidence in other areas – such as house prices and business activity. The research shows consumers are still pessimistic about their own finances, with YouGov’s data showing that following a year of economic growth they are still three times more likely to save a cash windfall than spend it.

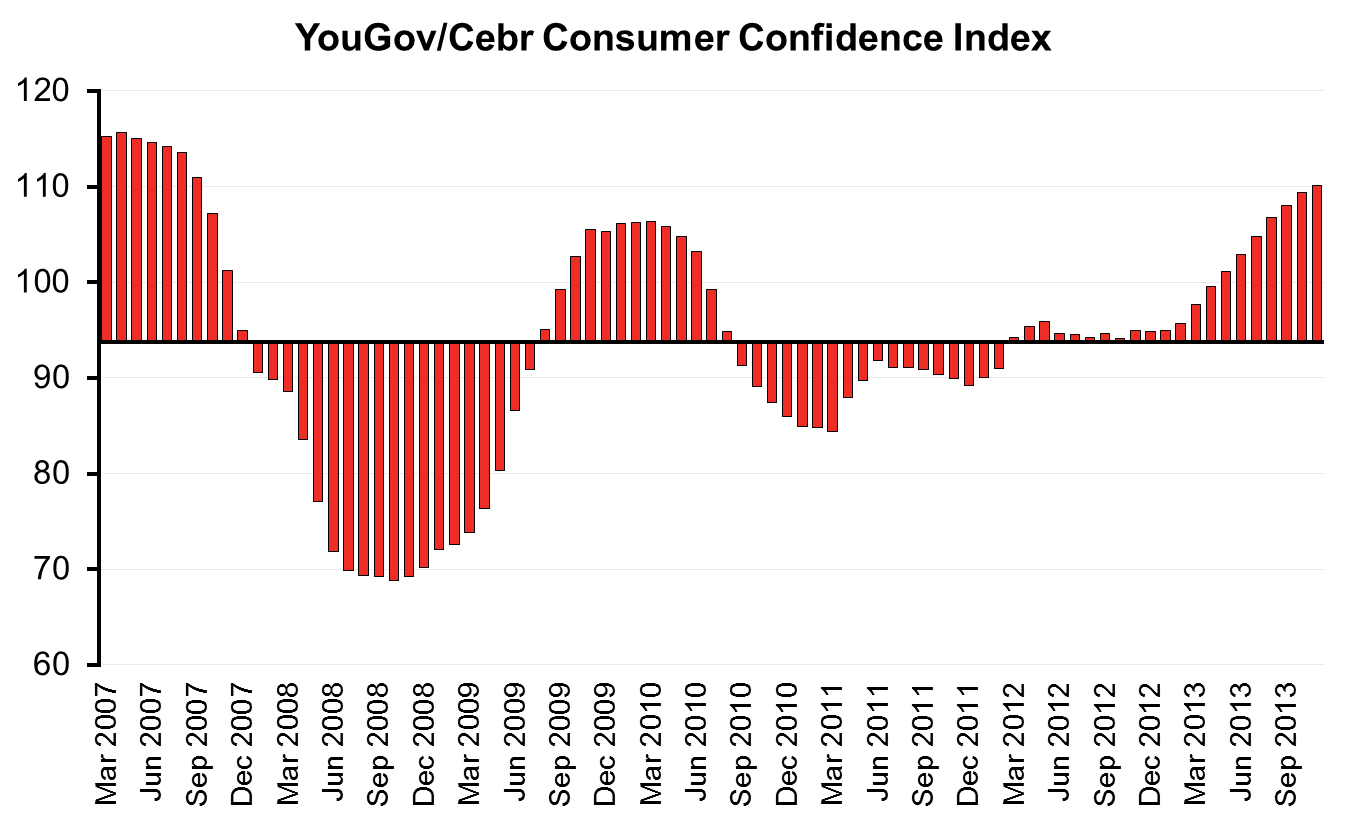

YouGov/Cebr Consumer Confidence Index

YouGov/Cebr’s Consumer Confidence Index for November shows UK households’ economic optimism rose for the eleventh month in succession, although the increase in the Index was smaller than any month since February.

This month’s headline figure – based on YouGov’s Household Economic Activity Tracker (HEAT) data – shows the Consumer Confidence Index at 110.1, up 0.7 points on last month. However, despite increasing for the 11th month in a row, consumer confidence is still more than five points below the level it was in April 2007, before the financial crisis.

Source: YouGov/Cebr HEAT data, November 2013, using a three-month rolling average.

Notes: Axis value of 93.7 represents the average HEAT Consumer Confidence measure since the data set began in 2007.

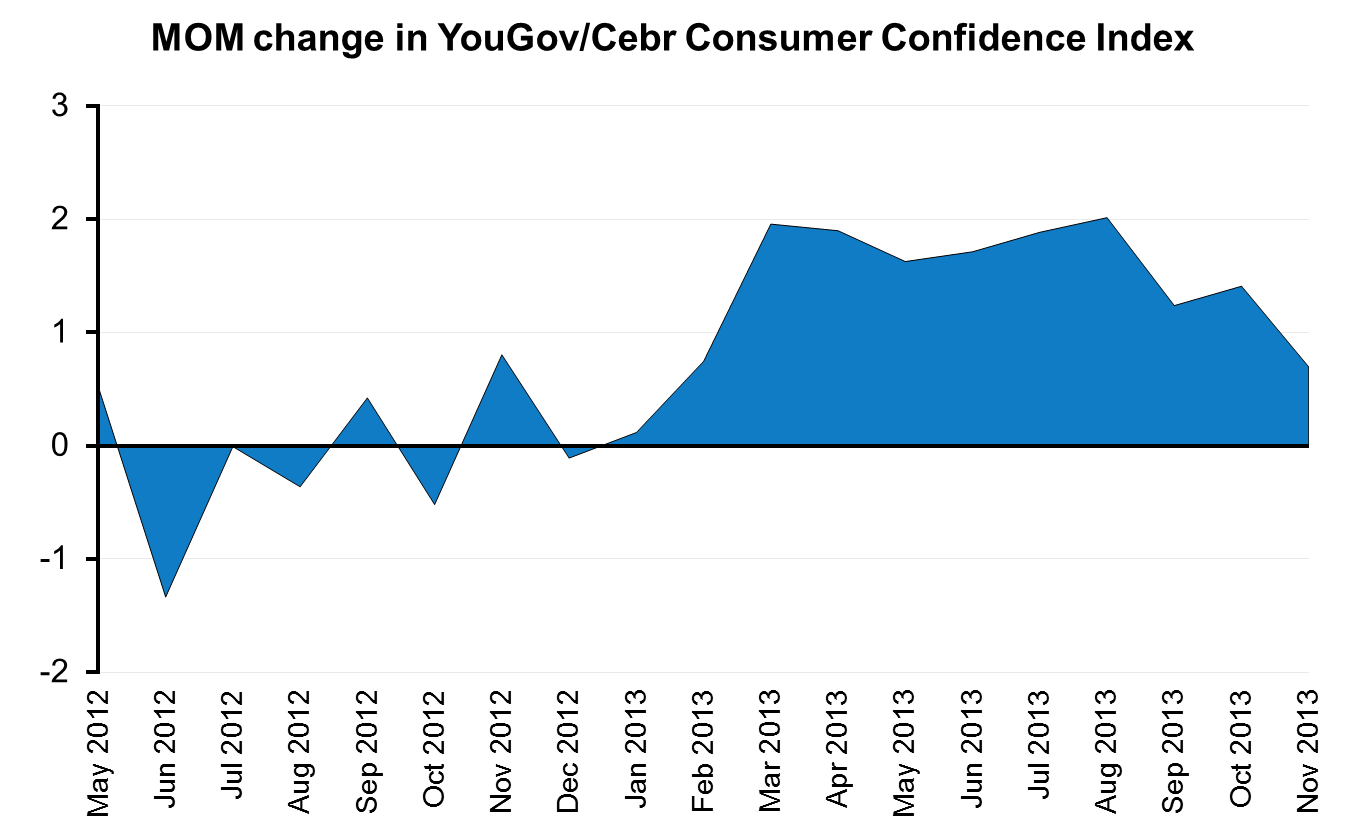

The data from the YouGov/Cebr Consumer Confidence Index suggest economic optimism could be starting to plateau. The 0.7 point rise in the Index in November is around a third of that seen in August when it grew by 2 points. The one month change in the Index is the smallest since February 2013 when the upward swing in consumer confidence was beginning.

Source: YouGov/Cebr HEAT data, November 2013, using a three-month rolling average.

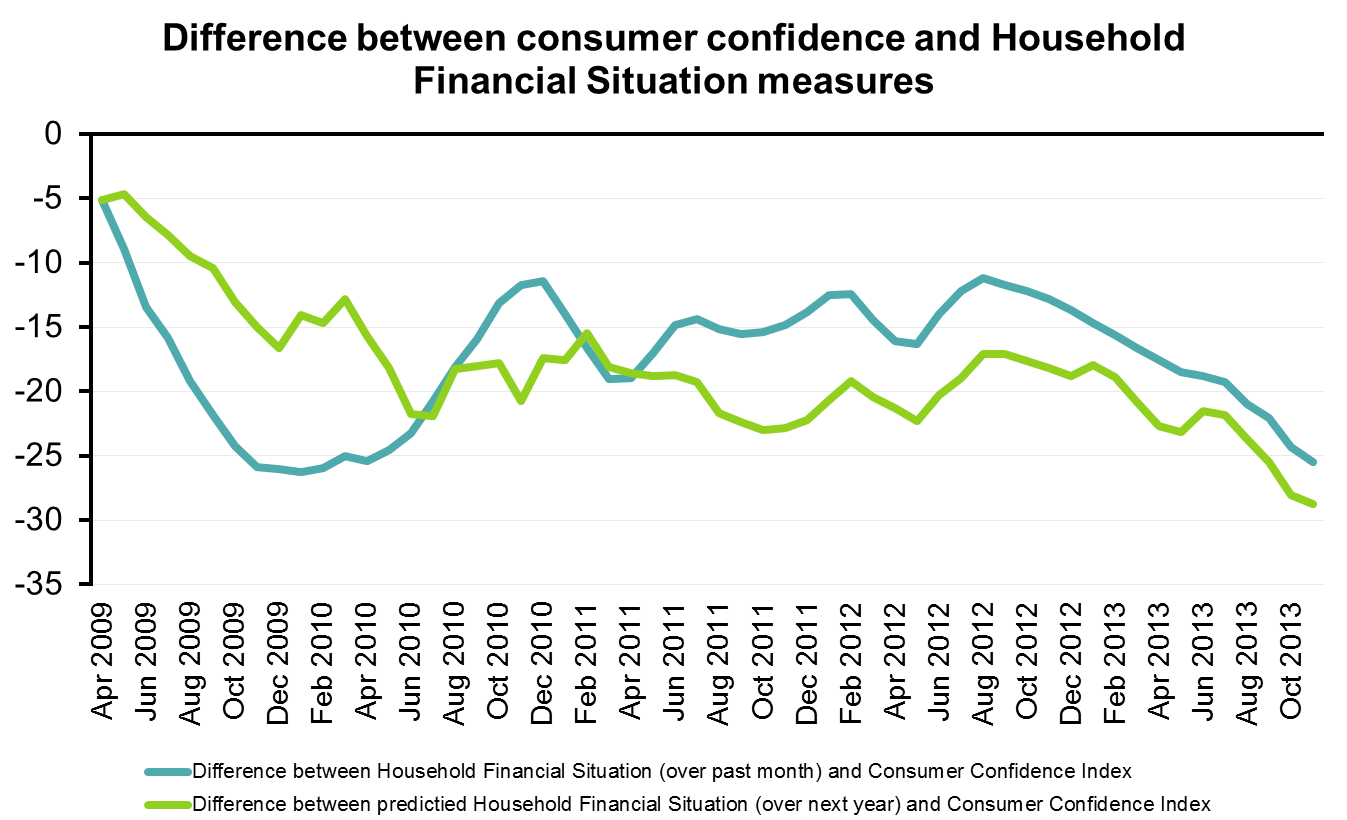

A widening gap: Household finances vs. general consumer confidence

YouGov and Cebr’s analysis shows that the gap between overall consumer confidence and how consumers feel about their own household finances is at its widest point since this set of data began four-and-a-half years ago. The YouGov/Cebr analysis measures both an overall Consumer Confidence Index and a Household Financial Situation score; there are indexed on the same 0-200 scale so that changes over time can be readily compared.

In April 2009, there was a five point discrepancy between the change in both household financial situations reported over the past month and expected over the next 12 months and the overall Consumer Confidence Index score. While both the backward-looking and forward-looking household finance scores have improved over the past two years, they have not kept pace with the surge in overall economic optimism captured in the YouGov/Cebr Consumer Confidence Index.

In November 2013, the gap between the overall Consumer Confidence Index and figures capturing the change in Household Financial Situation over the past month has grown to 25.5 points, while the forward looking measure lags the Consumer Confidence Index score by 28.7 points. This discrepancy is the result of a surge in consumers’ optimism over expected increases in property value and business activity at their place of work, both of which have inflated the Consumer Confidence Index to its current level.

Source: YouGov/Cebr HEAT data, November 2013, using a three-month rolling average.

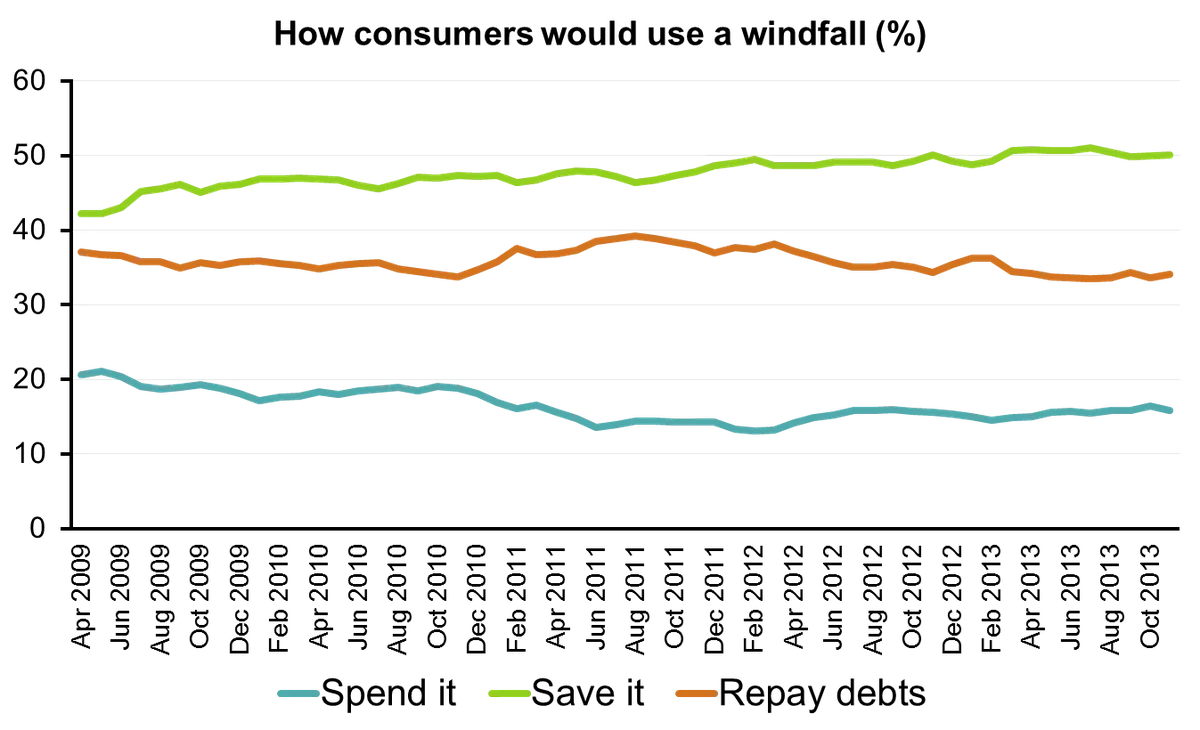

Further building this picture of underlying caution despite the wider improvement in the UK economy, the YouGov/Cebr data show that on-going pessimism about household finances means consumers are still cautious about spending. The latest figures show that consumers are three times more likely to save than spend a windfall. Half (50%) say they would save it, 16% would spend it and a third (34%) would put it towards paying off debts.

Since 2009, when YouGov began measuring how people would spend a cash windfall, the general trend has seen more people say they would save the money, a decline in the levels of those wanting to spend it and steady numbers go would put it toward s paying off debts.

Source: YouGov/Cebr HEAT data, November 2013, using a three-month rolling average.

Stephen Harmston, Head of Syndicated Reports at YouGov: ‘While consumer confidence is still improving, it looks like it is starting to flatten out. There is now a large discrepancy opening up between how they feel about different areas of their economic lives. Although they are seeing house prices continuing to rise and more activity in their workplaces, these are not things that help pay the bills in the short-term.

‘Add to this the fact that consumer confidence levels are still greatly below where they were before the financial crisis and it is clear why consumers – conditioned to caution – are not yet ready to spend. As a result, although economic optimism is generally increasing, businesses are not seeing the impact at their tills.’

Charles Davis, Associate Director at Centre for Economics and Business Research: ‘The surge in consumer confidence was a leading indicator for the acceleration in the UK economy through 2013. Indeed, we saw the fastest growth in growth in consumer spending since 2010 in Q3. Two months into the final quarter of the year it seems like an air of caution is hanging around – almost like the ghost of the financial crisis.

‘Although consumers know that the economy is improving– they perceive the pick-up in the housing market, are busier at the workplace and more secure in their jobs – they are circumspect about their own finances. While consumer spending has helped the recovery in 2013, there is a limit to how much the battle-hardened consumer can drive the economy forward. If the UK economy is to hit the Bank of England’s growth forecasts for 2014 it is going to take more business investment, export growth and higher pay growth to reassure the watchful post-crisis consumer.’

Look here for more information about the Household Economic Activity Tracker